Executive Summary

Join us as we unpack the highlights of the 2025 World Credit Union Conference, the largest European WCUC to date, held in vibrant Stockholm. In this blog, you’ll get a peek inside the conference, learn how innovation is redefining the member experience, get an inside look at Aequilibrium’s immersive VR Lounge, and gain valuable takeaways from sessions focused on AI, XR, leadership, and building resilient, human-centered financial cooperatives for the future.

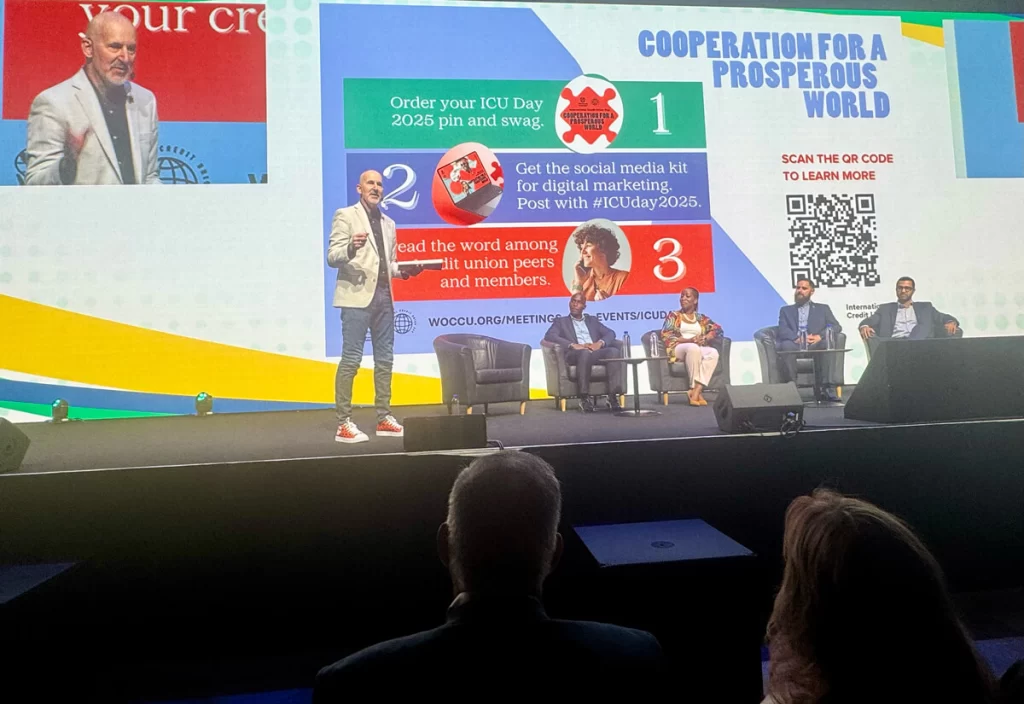

The 2025 World Credit Union Conference wrapped up in beautiful Stockholm, Sweden, as the largest European WCUC to date, drawing over 2,000 attendees from 55 countries. It marked the 20th anniversary of WOCCU’s global summit—a landmark event that energized leaders in financial cooperatives and reaffirmed the power of innovation, collaboration, and human connection.

Aequilibrium was proud to contribute to this global momentum, sponsoring the conference for the third consecutive year and showcasing the future of engagement through our immersive VR Lounge experience. Our CEO and Founder, Adrian Moise sat down with CU Broadcast host Mike Lawson on Day 1 to talk about immersive learning, how it’s changing the landscape of training for credit unions, and our VR lounge presence. Tune in to their talk here.

Aequilibrium’s VR Lounge: Immersive Innovation in Action

This year, Aequilibrium took center stage in the exhibitor hall with our VR Lounge, a hands-on demonstration of how emerging technologies are reshaping the member experience. Participants immersed themselves in simulations showing the future of digital banking, branchless service models, and human-centered design.

From virtual onboarding to empathy-driven UI prototypes, the booth sparked meaningful conversations on how credit unions can modernize without losing their human touch. One of the highlights was our VR Academy of Training, a subscription-based XR R&D initiative designed to empower credit union teams with AI-powered VR training scenarios. With three tiers (Standard, Enhanced, Bespoke), the model ensures every credit union can find the right fit for their team’s needs and budget.

The VR Lounge was a favorite among attendees, drawing steady foot traffic and glowing feedback. We were thrilled to see so many forward-thinking professionals embrace this vision of inclusive, tech-powered financial services.

Immersive Learning in Credit Unions: XR + AI in Workforce Development

Aequilibrium’s CEO and Founder Adrian Moise and his daughter, Product Manager Isabela Moise led a standout session on Day 2:

“Immersive Learning in Credit Unions: AI and VR Transform Employee Training.”

Their talk addressed a key question: How can credit unions leverage next-gen technologies to empower employees and improve member service?

Key takeaways:

- Why AI and XR are game-changers: Personalized, immersive training boosts engagement, retention, and confidence.

- Phased, scalable implementation: Any credit union, regardless of size, can begin its journey toward immersive training.

- Real-world use cases: From improving call center scripting with AI feedback to simulating VR-based member interactions.

“We are using XR and AI not just to train employees—but to build empathy, confidence, and readiness in a safe, adaptive environment.”

Adrian Moise, CEO and Founder, Aequilibrium

Their presentation aligned with trends outlined in America’s Credit Unions’ 2024–2025 Environmental Scan and sparked a lively Q&A with leaders eager to apply these innovations in their organizations.

WOCCU’s Strategic Pivot & Celebrations

WOCCU Board Chair Mike Lawrence and Interim CEO Paul Treinen outlined a bold, forward-thinking three-year strategy focused on:

- Proactive international advocacy

- Improved services for members

- Strengthened leadership in global cooperative finance

Treinen reminded attendees:

“We are no strangers to change… and we have proven to be nimble—not only in reacting to change but leading on it.”

WOCCU also welcomed NABARD (India) and IPACOOP (Panama) as new members, celebrated 50 years of the Worldwide Foundation for Credit Unions, and honored USF Credit Union and global leaders like Steven Stapp and Emmanuel Darko for outstanding contributions.

Elevating Emerging Leaders & Ethical Innovation

Throughout the conference, panels highlighted the importance of youth leadership and regulatory innovation.

Young Professionals Panel

The Youth Professionals Panel, including Kemar Cumberbatch and Kefilwe Masalila, addressed the challenge of aging leadership pipelines. Their stories emphasized the need for mentorship and the courage to lead—regardless of age.

“Let your age not be a limitation… unless you believe it is yourself, nothing is there to limit you.”

Kefilwe Masalila, CEO, BOSCCA

“They gave me the space to grow… they were there to give you that room to fall, helping you to grow in a particular role.”

Kemar Cumberbatch, President, Barbados Co-operative & Credit Union League Ltd.

Michelin-Star Thinking: Filene’s Call for Bold Credit Union Strategy

Mark Meyer, CEO of Filene Research Institute, delivered a compelling and imaginative talk that challenged credit union leaders to rethink their models for growth and relevance. Drawing inspiration from Michelin-star restaurants, Meyer emphasized the urgent need for “excellence to be better” in a changing financial landscape. He identified three critical threats facing credit unions: “We have to grow more robustly with members. We need to understand our members better. And we have to figure out how to ensure we have a healthy, robust liquidity of deposits.” Illustrating disintermediation with a striking example, he noted, “Starbucks… holds $1.8 billion [on their mobile app]—equal to one of those 455 credit unions. It doesn’t, in my mind, exist because it’s sitting serving… the shareholders of Starbucks, not the members of that credit union.”

Meyer called for leveraging behavioral data over survey questions: “What people say to us and what their behaviors and what they do is… different.” He stressed that “we’ve been Netflix’d,” urging credit unions to adapt to member expectations shaped by tech giants: “Can somebody join the credit union with a search, click, click, click, done… debit card or credit card delivered in the mail within 24 hours?” On talent and leadership, he emphasized, “We have to find people who are excited and passionate about the mission first… what got us here won’t get us there.” Drawing the full circle back to Michelin restaurants, Meyer left the audience with a challenge: “Can you just imagine… if that is how people thought about your credit union and your credit union experience… is that even possible in financial services?”

From Compliance to Commitment: Credit Unions and the Sustainability Imperative

One of the most resonant sessions at WCUC 2025 tackled the intersection of sustainability and cooperative values, challenging credit unions to move beyond regulatory checkboxes and lead with purpose. Wellington Holbrook, CEO of Vancity, set the tone with a candid reminder: “If you think that this is about regulatory reporting, you’re missing the point. This is about your values… and it’s the next big one, and the one that matters the most, because it’s about the planet.” The panel explored how credit unions are responding not just to the pressure of evolving sustainability mandates, but to the deeper call for climate action and community stewardship.

David Malone, CEO of the Irish League of Credit Unions, acknowledged the complexity of the current environment: “From a regulatory point of view, there’s a lot of complexity, a lot of fragmentation… There’s a sense of moving towards a common standard, but it’s going to take time.” In the face of this, he emphasized the importance of taking action now: “We need to show we’re making progress.” Both leaders urged the sector to view sustainability as a strategic opportunity rather than a compliance burden. “My advice to you is to stop thinking about it like a compliance exercise,” Holbrook added. “It’s not. It’s about change, and it’s about what’s important to your members and your communities.”

Throughout the discussion, collaboration emerged as a recurring theme. As Malone put it, “The scale of what needs to be done is so big that we need to learn and lean on each other. Collaboration is key.” By embedding sustainability into governance, strategy, and everyday operations, the session made clear that credit unions are uniquely positioned to lead the transition to a more just and climate-conscious economy—starting with small wins and shared stories that ripple across the movement.

Emerging Technologies and Policy: Where are We Headed

This panel focused on the intersection of regulation and technology in the financial services sector, with much of the conversation revolving around whether regulations should be applied to specific technological tools or focus more on overall principles.

David Heine, CEO of Regional Australia Bank, said:

“You can’t nail it down and regulate a specific version (of a tool). I mean, how many different versions of AI do we all have on our phones? You can’t treat it from that point of view,” said Heine. “There are some weaknesses in a principles-based approach, of course. It becomes gray for practitioners to understand, necessarily, what the outcome is and what you’re trying to drive toward, but we’re left with no choice, in my view.”

But even on a principles level, the panel agreed regulators must take a holistic approach to technology.

“In policy terms, there’s a triangle. And, if you’re a policymaker, you often have various objectives you want to pursue. You may want to pursue competitiveness and effectiveness, and performance—and that’s a very valid objective. But you may also want to pursue privacy protection—very important,” said Peter Kerstens, Technology Adviser for the European Commission. “But if you go to pursue one of these objectives to the extreme, the two other objectives are going to suffer. And that’s why policymakers—in my view—have to try to place themselves somewhere in the middle of the triangle.”

Connect and Collaborate: A New Conference Highlight

A welcome addition in 2025, the Connect and Collaborate workshops offered attendees a structured space to share administrative and strategic challenges. Divided by credit union size, these sessions produced some of the most meaningful exchanges of the event.

It was really good… parental leave, succession planning—all sorts of topics.”

Pat Pierce, Chair, America’s Credit Unions’ Board of Directors

“We believe by sharing ideas with people all over the world, it will help us build up-and-coming credit unions.”

Farida Toma Haji Bashir, Boresha DT SACCO Society Ltd.

Future of Work: Eric Termuende’s Vision for Trust-Driven Teams

The conference concluded with a vibrant and practical keynote from Eric Termuende, Co-Founder of NoW of Work. His talk, “Blueprint to the Future: Leading in a New World of Work,” inspired leaders with real-world strategies for building strong, resilient teams.

Termuende’s message was clear:

“Your best recruitment strategy is a good retention strategy.”

From his “gas station sushi” metaphor to the Cleveland Browns’ cultural turnaround under Coach Kevin Stefanski, Termuende illustrated how trust is the foundation of high-performing teams. His concept of “one-degree shifts”—small, intentional changes that reduce friction—resonated deeply in a rapidly evolving work landscape.

Looking Ahead: WCUC 2026 in Sydney, Australia

The closing celebration at Stockholm Waterfront Congress Center capped off a transformative week. With over 30 sessions, 50+ speakers, and 2,000+ attendees, WCUC 2025 set a high bar.

We’re already looking forward to WCUC 2026, co-hosted with COBA, in Sydney, Australia. It will be the first time Sydney hosts this global gathering—and Aequilibrium is excited to be part of it.

Thank You to the Global Credit Union Community

We extend our heartfelt thanks to WOCCU, the inspiring speakers, and every credit union leader we had the chance to connect with. Special recognition goes to:

- Eric Termuende, Co-Founder of NoW of Work – for his unforgettable closing keynote

- Kemar Cumberbatch, President of the Barbados Co-operative & Credit Union League Ltd & Kefilwe Masalila, CEO of the Botswana Savings and Credit Cooperative Association, for championing the next generation of young professionals

- David Heine, CEO of Regional Australia Bank & Peter Kerstens, Technology Adviser for the European Commission, for forward-looking regulatory perspectives

- Wellington Holbrook, President and CEO of Vancity, for showing how purpose-driven finance creates real-world impact

- Confidence Staveley, Author – for spotlighting digital trust in an era of rising threats

Together, we’re building a digital, inclusive, and profoundly human future of finance—a future where technology enhances rather than replaces the relationships at the heart of credit unions.

As AI, VR, and other innovations reshape how we work, learn, and serve our members, it’s clear that the most successful organizations will be those that blend cutting-edge tools with deep empathy, trust, and shared purpose.

At Aequilibrium, we believe that true transformation happens when innovation is accessible, when talent is nurtured, and when member experiences are designed around real human needs. The conversations and collaborations at WCUC 2025 reminded us that the path forward is not about choosing between tech and people—it’s about bringing the best of both together.

We’re honoured to walk this path alongside credit union leaders from around the world—and we’re just getting started.

— The Aequilibrium Team

Ready to take the next step in your digital transformation?

Connect with our team to explore innovation strategies, future-proof technologies, and how we can support your credit union’s journey forward.